1. Saving

Live below your means, look what you earn

Should I spend money on something? optimize the freedom money get rather than the money itself

New grads? save money for what you want

How much should spend?

Marriage? Different styles

Kids, how money works, how things work,

College, consider the growth of tuition and investment

Monthly bills

- Mortgage

- Utilities

- Insurance

- Car loan

2. Interest and Debt

Rule of 72: (very good approximation)

- if APY is 10%, the money would double in 72/10=7.2 years

- if APY is 6%, the money would double in 72/6=12 years

Federal Reserve control the interest rate to contrl the economy

- Low rate: more shopping, more job

- High rate: less shopping,

Credit: FICO, give a score of creadit

Three credit bureaus

- Transunion

- Experum

- Equifax

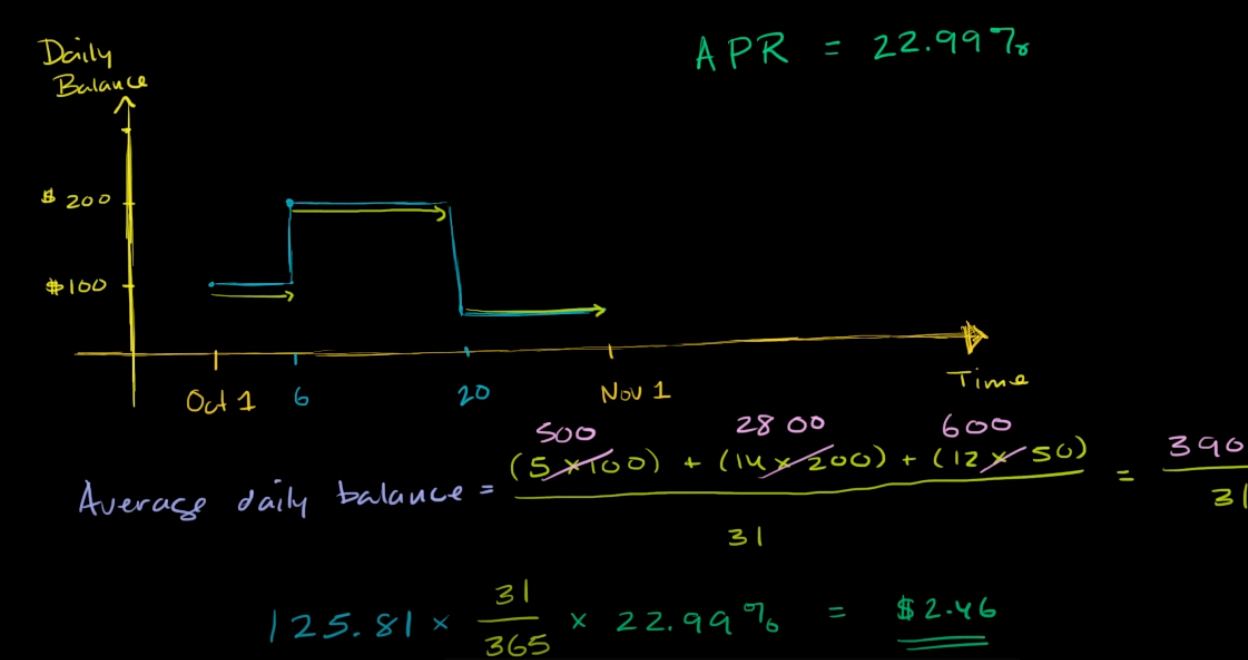

Interest in credit card

calculate the average daily balance

- if you pay off, no interest

- if there is balance left, you pay below

Build credit, use chime and pya

Processors,each processor have bank in network

- Visa

- Mastercard

- Amex

- Discover

Store should be in the same network to receive the money from the same network

Each payer is providing services, like 2% to the bank

Bankruptcy: if you can’t pay back

- Ancient Greece, become the debt slave

- In prison, family pay off

- Bankruptcy

- Chapter 7: straight, stay on credit report for 10 years, some loan are never forgiven

- Chapter 13: reorganization, pay in the next 3-5 years, stay on

3. Investment

Retirements

- Traditional IRA, gain interest in a larger base. Only taxed when withdraw

- Best if you withdraw after age 60

- Roth IRA,tax not deferred. NO TAX when withdraw

- Best if you withdraw before 60, need more flexible

- And if you in higher tax bracket in retirement

- 401K,very similar to Traditional IRA,pay income tax on total distribution

- Higher limit

- Organized by employer

Penalty: 10%

Different company have different 401K policy. When change job

- to IRA

- to new 401K

- stay in old 401K

Open-ended and Close-ended mutual fund

- Open: can create new share

- Closed: only trade existing share

Exchange Traded Funds: more flexible

Ponzi Scheme: more in than out

Stock: part owner of company, money isn’t guaranteed

Bond: part lender to the company, company pay interest and pay off principle

Asserts: Thins can be in cash

Asserts=Liabilities + equity

fair price should be equity/(share numbers)

Cap=current price * (share numbers)

4. Income

See paycheck

How allowance works

5. Housing

Rent Vs Buy

Buy: stability

- Down payment

- Interest

- prop tax

- house keeping

Rent: flexibility

- gain interest

Consider the out of pocket money,

- Consider how much money burn in every year if you buy or rent

Loan: the longer, the more risky

Short sale

Ballon payment, share the risk between buyer and bank

How to solve

$$

((L(1+i)-P)(1+i)-P)…=0

$$

Solve P

$$

P=L(\frac{1-r}{r-r^{n+1}})

$$

where $r=\frac{1}{1+i}$

Title of the house? Called deeds